2022 ExportNZ DHL Export Barometer Survey Report

ExportNZ and DHL partner annually to survey exporters about the industry environment and their expectations for the future.

This year’s survey showed us that exporters are optimistic about their exporting futures (67 per cent expect to grow their international orders in 2023), but rising costs are the big concern.

For three years running, the cost and availability of transport and logistics remain the number one barrier to exporting, with 67% of respondents citing this. According to the 334 Kiwi exporters surveyed, the unpredictability of the global supply chain is a continued strain being felt by Kiwi exporters. 88% of those surveyed say delayed transit times and increased costs are hampering supply chains over the past 12 months, with a further 48% unable to secure shipping space.

Additional barriers highlighted by exporters include the high cost of doing business in New Zealand with 34% stating this as a key barrier and 24% of respondents listing the value of the New Zealand dollar as a major roadblock.

You can read the full report HERE.

Go Global Recap – Vangelis Vitalis, Chief Trade Negotiator

At our annual Go Global Conference earlier this month, New Zealand’s chief trade negotiator, Vangelis Vitalis gave a no-holds-barred view of the global trade environment. Heralding the “end of the golden weather” for New Zealand trade policy, Vitalis highlighted “war, plague [Covid-19], potential food shortages, famine, and climate changes as the ongoing challenges we need to address at the international level – a truly difficult environment to navigate over the coming years.

Vitalis also talked about the Trade Recovery Strategy 2.0 currently put in place by the Ministry of Foreign Affairs and Trade – STAR – to help the post-Covid recovery.

- Sustainable, support for the Trade For All Agenda

- Trade & Export Lift, lifting the capabilities of exporters

- Architecture, utilizing free trade agreements and multi-lateral organisations

- Resilience, addressing vulnerabilities and strengthening against future shocks

Our Chief Trade Negotiator focused on two points, Architecture and Resilience. The Ministry is currently looking to build an FTA safety net to ensure exporters and New Zealand have the ability to take cases to an authorized body to ensure free trade rules are followed. With the free trade agreements with the UK and European Union, New Zealand will have 74 per cent of its global trade covered by at least one free trade agreement.

Speaking about Resilience, Vitalis focused on the need to create depth in our trade relationships and the need to think creatively about how we expand our trade relations. Latin America and Africa are real opportunities and PACER Plus gives us the opportunity to help our Pacific partners build their trade capability.

On The United States of America, Vitalis said that there is real scepticism around free trade and a global rules-based trade system. However, there are two strong signals that the US want to continue to engage in the global trade system, that is their Indo-Pacific Economic Framework, and their hosting of APEC 2023 in San Francisco next year.

With India, Vitalis called an India-New Zealand Free Trade Agreement a distant prospect and urged patience. He did encourage the exporters in the room to continue engaging in their own ways as New Zealand continues to build its relationship with India.

United Kingdom-New Zealand Free Trade Agreement

It is now highly unlikely the UK-NZ FTA will come into force at the start of 2023 as we had hoped, given the more complicated ratification process in the UK.

Meanwhile, the New Zealand process is all done and dusted. The United Kingdom Free Trade Agreement Legislation Act 2022 received royal assent on the 15th November, so now all we can do is wait. Once the UK has completed its domestic process, both countries will work together to set an entry-into-force date.

European Union-New Zealand Free Trade Agreement

We’re hoping to see the NZ-EU FTA signed by mid-2023, subject to the required processes by New Zealand and the EU being completed in time. A legislation bill for the NZ-EU FTA would then need to be passed by the New Zealand Parliament before the FTA can come into effect. The European Parliament would also need to approve the FTA. All going well this could occur and allow the FTA to come into force in 2024.

Latin America – Prime Minister’s Speech at Annual BusinessNZ CEO Dinner

At the Annual BusinessNZ CEO Dinner with the Prime Minister earlier this month, the Prime Minister mentioned a focus on progressing free trade agreements with Latin American countries.

“I can share with you that as a Government we will be looking closely into making free trade progress with Latin America.”

Trade negotiations on the Latin America front have been quiet for a few years. There has not been a formal round of negotiations with Pacific Alliance countries (Mexico, Peru, Chile, and Columbia) since 2019.

While we already have existing agreements with three of those countries (all but Columbia), a free trade agreement with the Pacific Alliance would support the Resilience part of MFAT’s trade recovery strategy and add depth to our global trading relationships.

ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA) Upgrade

ExportNZ is pleased that the negotiations to upgrade the AANZFTA have concluded and will be signed shortly.

AANZFTA has been crucial to our trade links with Southeast Asia and as that region continues to grow, so will our trading relationship. Upgrading the Agreement to support our strengthening economic ties is also an important part of New Zealand’s global trade strategy.

With the original Agreement, New Zealand achieved almost full tariff elimination on goods, so 99 per cent of New Zealand goods exports already enter the ASEAN market duty-free. The benefits of the Upgrade for goods exporters seem to be around improving the processes and procedures at the border. Faster clearing of goods, giving new options for proof of origin and addressing non-tariff barriers – so clearing out some of the red tape that impedes business and trade between New Zealand and Southeast Asia.

Supply Chains and Logistics

Domestic

New Zealand is trending slower than the global trend, this is because New Zealand did not see the same price extremes that were experienced elsewhere, and our supply and demand balance has not altered significantly, yet.

Schedule reliability in New Zealand is still incredibly low (20 per cent, compared to pre-Covid 80 per cent, and the current global average of 45 per cent). And we’re hearing that port congestion has worsened, not improved, since the start of 2022.

International

Global supply chain pressures again decreased in September, making this the fifth consecutive month of easing. The Global Supply Chain Pressure Index has fallen from a high of 4.31 in December to 1.47 in August and now 1.0 in October – (the pre-Covid value of the index was 0.0). Pressure slightly increased in October is attributed to pressure from Taiwan delivery times, Taiwan purchases, Asia outbound airfreight, and backlogs in the UK.

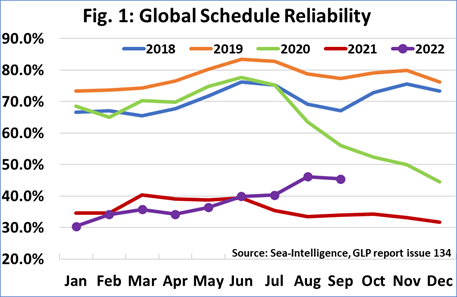

Global schedule reliability also declined slightly to 45.5 per cent reliability in September (from 46.2 per cent). Global service reliability continues to be well below pre-Covid normality (around 75-80 per cent).

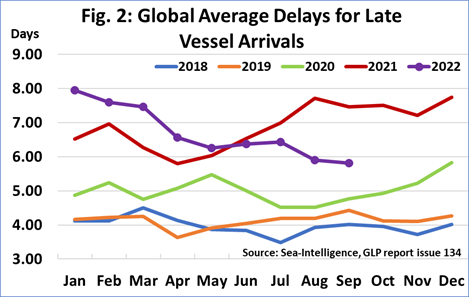

The average delay for late vessels fell again, albeit slightly, and sits below six days in September, another year-on-year improvement in 2021.

Overall, the feedback is that global supply chain issues continue to slowly ease. There have been significant decreases in demand for some East-to-West services, and there is a weak outlook for European exports due to energy and labour issues.

Credit: Sea Intelligence, October 2022

The Ministry of Foreign Affairs & Trade published its Quarterly Monitoring Global Supply Chains Report last month is worth a read, click here for that report.

MfE: Pricing Agricultural Emissions [Submission Completed]

The Ministry for the Environment consulted on their proposal to price agricultural emissions in New Zealand. This will include how the levy is set, governance arrangements of the system, how farmers will report and pay for their emissions, and recognizing sequestration.

ExportNZ and BusinessNZ wrote a joint submission opposing the proposals made in the consultation document. Our organization is committed to helping New Zealand achieve the obligations made within the 2015 Paris Agreement, however, we do not believe the proposal from MfE takes into serious consideration the significant impacts on the New Zealand export sector or regional economies.

Our submission details our main concerns with the document’s proposals, namely: the recommendations from the IPCC, the impact on New Zealand’s Export Value, Carbon Leakage, Land Use Changes, and the Impact on Rural Communities.

You can find more information on the proposal here on the MfE website. You can also read the Prime Minister’s announcement here.

You can access the BusinessNZ/ExportNZ submission here.

MBIE: Future of the Skilled Migrant Category [Submission Completed]

The Ministry of Business, Innovation, and Employment recently consulted on their proposed new settings for the Skilled Migrant Category residence visa.

ExportNZ wrote a letter of support for the comprehensive BusinessNZ submission that was made. Our letter spoke to how important open, simple, and permissive immigration settings are for exporters needing to source skills and talent that are not available here in New Zealand.

You can read our Letter of Support here.

MFAT: Trade and Labour Framework Review [Submission Completed]

The Ministry of Foreign Affairs & Trade (MFAT) and the Ministry of Business, Innovation, and Employment (MBIE) are reviewing the 2001 Trade and Labour Framework as part of the ‘Trade For All” recommended process.

BusinessNZ and ExportNZ advocated for a status quote approach to a Trade & Labour Framework, namely, that our approach is premised on the recognition of the ILO Declaration of Fundamental Rights and Principles at Work 1998.

The Discussion Document can be found here, and our submission is here.