February 2023

CPTPP – UK Negotiations Close to Ending?

It has been a good few months for CPTPP. Malaysia and Chile have ratified the agreement. Of the original members, this only leaves Brunei as not yet ratified. Officials seem hopeful that Brunei will ratify the Agreement sometime this year. Meanwhile intensive negotiating and political activity has been taking place over the UK’s application to join the agreement. CPTPP senior officials met on 21 February and it is clear that more work is needed before the negotiation can be finalised. A meeting in Tokyo is expected next week. At least one senior official is hopeful that the UK process will be out of the way by mid-year.

Meanwhile other applicant economies are waiting to hear how their applications are to be handled. Separate working parties to consider the ability of applicants to meet CPTPP provisions is probably the best way forward here but no decision on establishing these has been taken. Some applicants may be further from meeting the standard than others and it would be unwise to bundle them all together. China, Taiwan, Costa Rica, Ecuador and Uruguay are in the queue.

CPTPP Ministers are due to meet in New Zealand in July. Decisions on how the new applications are to be handled will be expected by then (at the latest). Senior officials meet again in person on 18 and 19 April.

UK and EU Free Trade Agreements

Work to ratify these two important agreements continues. All public comments are positive. It would be fantastic if both agreements are in force by 2024. 2023 would be even better.

Significantly the EU, late last week, released the text of the Agreement with New Zealand. This is a necessary precursor to the ratification by EU Council and European Parliament.

Indo-Pacific Economic Framework

Some are dismissing the current negotiations on the US-led Indo-Pacific Economic Framework as unimportant because it does not include “hard liberalisation” of trade barriers. This position may be a mistake. As more detail emerges on IPEF it would appear far-reaching enough to be of interest to many New Zealand companies.

IPEF currently involves the United States, Australia, Brunei, Fiji, India, Indonesia, Japan, Korea, Malaysia, New Zealand, the Philippines, Singapore, Thailand and Vietnam. It is deemed sufficiently important for New Zealand that our chief negotiator is a former MFAT Deputy Secretary and former Chief Trans-Pacific Partnership negotiator, Mark Sinclair.

While IPEF’s trade pillar currently avoids the issue of tariff liberalisation it does seem to be requiring significant change in regulation from potential signatories. It is hard to see whether the United States is willing to make any significant concessions of its own.

Issues covered are, in some cases, controversial. The proposal to include more stringent labour and environmental standards shouldn’t cause New Zealand any issues, but what about rules prohibiting taxes on digital flows or a prohibition on rules that force data to be stored locally? This last issue was a major focus in the last days of the UK and EU FTA negotiations with some here in New Zealand expressing concern about data being stored offshore. Agreements to govern the speed of de-carbonisation and e-commerce rules also appear to be in scope.

Cyclone Gabrielle

We are saddened to see the devastation and destruction caused by Cyclone Gabrielle and other recent extreme weather events across the North Island. ExportNZ is committed to supporting our farmers, growers, and exporters in whatever way we can.

BusinessNZ Network members EMA have set up an advice line for businesses affected by recent weather events. Free phone 0800 500 362 (Mon-Thurs 8am-8pm and Fri 8am-6am)

Ministry for Primary Industries (MPI) has also released a comprehensive factsheet for the support currently available to growers and exporters accessible below. MPI will also be working directly with sector associations directly to offer support where it is needed most.

Recovery Funding Available

The government has committed $25 million to help farmers, growers, and whenua Māori owners recover from Cyclone Gabrielle. Any farmer or grower significantly affected by the Cyclone can apply for the grant here.

The grant can be used for the following costs:

- Staff costs associated with clean-up;

- Cost of contracting companies;

- Cost of advice to help with the clean-up and recovery activities.

If there is anything else ExportNZ and BusinessNZ can help with please do not hesitate to contact our team via [email protected]. Our network spans both Private and Public sectors and we want to ensure your concerns are being heard.

Supply Chains and Logistics

Domestic

Vessel schedule reliability continues to be poor and port congestion continues to be a problem due to capacity challenges and labour shortages.

New Zealand ports are still committed to reinstating fixed berthing windows from March 2023.

The significant weather disruptions and Cyclone Gabrielle have caused delays to some vessels’ schedules as ports in the North Island were forced to halt operations and close yards.

International

Global supply chain pressures continue to decrease. The Global Supply Chain Pressure Index has fallen from a high of 4.31 in December 2021 to 0.95 in January 2023. Contributing factors to the decline in overall supply chain pressure were reduced delivery times in Korea, China, and the EU.

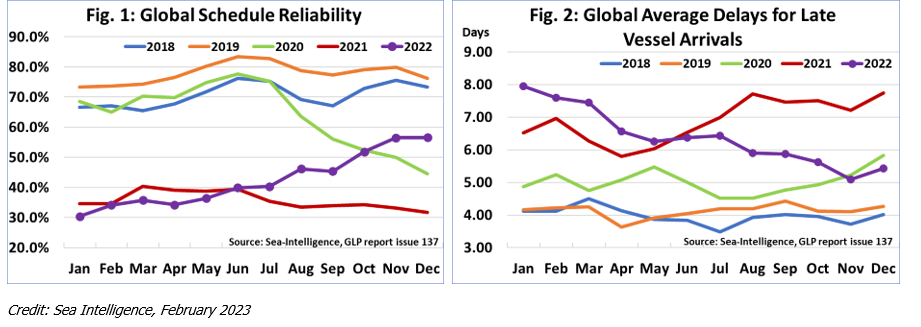

According to Sea Intelligence, global schedule reliability held steady between November and December at 56.6 per cent reliability. While global service reliability continues to be well below pre-Covid normality (around 75-80 per cent) it does show that things are continuing to slowly get better in the sector.

The average global delay for late vessels increased slightly to 5.43 days.

MPI: Food & Beverage Draft Industry Transformation Plan

The Ministry for Primary Industries released the Food & Beverage Draft Industry Transformation Plan in early December for consultation.

MPI has divided the plan into four ‘transformation’ with 16 proposed actions.

- Orienting the sector towards consumers and the market,

- Increasing investment in innovation and attracting capital for growth,

- Building capability to innovate, commercialise, and improve productive capacity,

- Regulatory setting enabling food innovation.

ExportNZ will be submitting feedback on the draft plan And is keen to hear feedback from F&B exporters, especially in regard to the chapter regarding regulatory settings as it is critical for the Ministry to have feedback on exporter experiences of the regulatory environment.

You can read the full Draft Plan here. The consultation period until 5th March, ExportNZ will be in touch with F&B members soon, but if you would like to get in contact with us, please email: [email protected].