Our predictions last month about Prime Ministerial travel to China and Brussels have proven correct. The Prime Minister leads a sizeable trade delegation to China next week and will travel to Brussels at the time of the July NATO summit to progress the FTA with the EU. Both visits are very welcome from an export perspective.

CPTPP Expansion

One of the issues that the Chinese are sure to raise in meetings with the PM will be China’s application to join the CPTPP agreement. The application has been sitting there, along with applications from Taiwan, Costa Rica, and Ecuador for some time. More recently Uruguay and Ukraine have applied for membership. Until now, existing members have been able to use the need to progress the UK membership application (the UK was the first to apply) as a justification for no decisions on new applications. But with the UK accession almost complete (hopefully, the deal will be signed in New Zealand in mid-July when CPTPP members assemble for their annual Ministerial) this is looking a bit thin as an excuse. China will no doubt be pointing this out.

How to handle the accession applications will have to be discussed in July. Many suggest that the logical way forward would be to set up working parties on each accession and allow these to progress at their own pace. Presumably, those applicants with trade regimes that are close to conforming to, or already conform to, CPTPP rules would progress more quickly than those who have more work to do to bring their regimes into conformity. Unfortunately, politics appear to be a factor. Some are suggesting that China should be brought in even though it cannot easily meet some of CPTPP rules. Others worry about the China/Taiwan dynamic. Others seem to be wanting Ukraine treated as a special case and brought in for political reasons. Yet others still hold out hope that the US will want to join the agreement at some point in the future and worry about having China as a member before then. The CPTPP members have an interesting meeting coming up in mid-July.

It is interesting to note that very much the same issues are on the table over Ukraine’s membership application for NATO.

While having Ukraine (and the others) as a member of CPTPP is an exciting prospect it is important that this agreement remain a high standard agreement. That standard should not be dropped for political considerations.

Other options?

With the NZ-UK FTA in force and with the EU-NZ agreement looking like it is not far away from absolute finality, some are suggesting that New Zealand has no other prospects for improved trade access beyond CPTPP. Certainly, there are no active negotiations in immediate prospect. But there are opportunities. We have talked before about looking hard at a bilateral negotiation with the UAE now that a negotiation outcome with the Gulf Cooperation Council (or which the UAE is a member) looks unlikely to progress in a hurry. Several other jurisdictions have negotiated bilateral deals with the UAE.

There doesn’t seem great interest on either side, but one consequence of the EU-NZ deal is the need to look at Turkey. Turkey is in a partial customs union with the EU and those parts that are covered will need to apply to New Zealand. New Zealand has no obligation to reciprocate this improved market access so a negotiation would make some sense. But Turkey has very restrictive rules are some meat and dairy imports. Attempts in the past to engage with Turkey on an FTA have failed.

What about MERCOSUR (a FTA with Brazil, Argentina, Uruguay and Paraguay has been talked about for many years and now we have Uruguay seeking CPTPP membership)?

And what about Africa? Kenya has tried negotiating with the US and is negotiating with the EU. Why not New Zealand? There are some exciting markets in Africa that are only going to become more exciting as populations grow and economies develop.

We should not take our eyes off the good dairy markets of Pakistan, Bangladesh and Sri Lanka either. An FTA with Sri Lanka has been talked about several times. Pakistan and Bangladesh are only going to grow in importance.

None of the above possibilities are going to be easy, but there were many who in the late 1990s and early 2000s were saying that FTAs with China, Japan and the EU were never going to happen.

IPEF Delivers an Outcome

Many have been sceptical of the value of the US-led Indo-Pacific Economic Framework (IPEF). This initiative appears to some to be an attempt by the United States to appear to stay engaged in the Asia Pacific but without having to agree to any meaningful trade liberalisation. Certainly market access is not part of the IPEF agenda. But potentially useful discussions on facilitation and resilience are being held and the first outcome has been achieved.

Details of the Indo-Pacific Economic Partnership Agreement on Supply Chain Resilience can be found here: https://www.beehive.govt.nz/release/agreement-between-indo-pacific-partners-supply-chain-resilience

Under this Agreement Partners undertake to:

- Promote regulatory transparency in areas that may impact IPEF supply chains;

- Develop a shared understanding of global supply chain risks through each Party identifying their critical sectors and key goods in their supply chains;

- Monitor for and address supply chain vulnerabilities; and

- Promote responsible business conduct and transparency in terms of upholding labour rights in supply chains.

It will be interesting to see how this Agreement develops.

Supply Chains and Logistics

Domestic

Supply chain reliability for New Zealand exporters has increased significantly since January (15 per cent) and now sits at around 47 per cent (pre-Covid average was 70-80 per cent). Conditions are forecast to continue improving.

Ports of Auckland is reporting that operations have been running satisfactorily, and reports from other ports have been good.

International

Global supply chain pressures continue to ease according to the Global Supply Chain Pressure Index. The Index has seen another decrease currently sits at -1.71 this is from a high of 4.31 in December 2021 to 0.96 at the start of 2023.

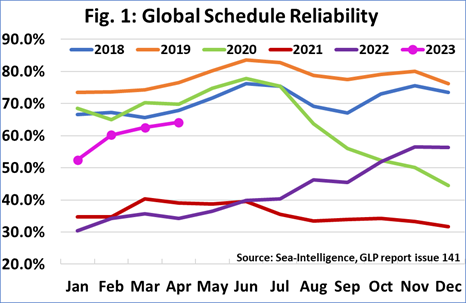

Sea Intelligence continues to reflect the improvements in their data as well. Figures show continuing improvement in global schedule reliability – up to 64.2 per cent, a 1.7 per cent month on month increase). Year on year this figure is a 29.9 per cent increase from April 2022.

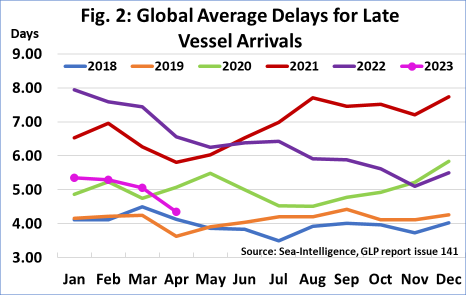

The average global delay for late vessels decreased again slightly to 4.34 days. Significantly lower than April 2021 and close to April 2018 levels.

Credit: Sea Intelligence, 29 May 2023

ExportNZ DHL Export Barometer Survey 2023 – Election Year Survey

New Zealand’s exporters know the challenges and opportunities that come with international trade better than most, so we need to hear from you.

This election year, the results of this survey will also factor into our pre-election report and recommendations for the next government, which goes to each political party.

The business environment both at home and abroad remains tricky to navigate for New Zealand exporters. Through this survey last year, you told us the leading barriers to exporting included the cost and availability of transport and logistics, and the high cost of doing business in NZ.

ExportNZ advocated strongly for change based on your responses and we want to make sure we’re still tackling the most critical barriers to exporters in the lead-up to Election 2023.

To show our appreciation, all entries will go into the draw to win a 2023 DHL Super Rugby Pacific signed jersey (The winner can choose their team – Blues, Moana Pasifika, Highlanders, Crusaders, Hurricanes, Chiefs), AND a $250 Noel Leeming voucher from ExportNZ.

Complete the survey before Friday, 30th June 2023 and make sure your business is heard, it’ll take less than 10 minutes.