Comprehensive & Progressive Trans-Pacific Partnership

The month began with big trade policy news. An agreement in principle was reached between CPTPP members to allow the UK to join the agreement. There is still some work to do before the UK is able to sign the Agreement. The lawyers need to scrub the text. The scrubbed text then needs to be translated into CPTPP languages. And some members need the approval of their legislators to approve UK accession. Officials are working towards signature of CPTPP at the next meeting of CPTPP Ministers in New Zealand in July, but this target could slip. Once it has signed the Agreement the UK will be able to participate in CPTPP meetings with speaking rights. It will not have a right of veto until such time as it ratifies the Agreement.

With the UK accession issue largely out of the way, CPTPP officials were able to discuss other issues at their meeting in Auckland last week. These issues fell into three categories – how to keep the Agreement updated so it remained the “gold standard”; what to do about the five economies that have applied for accession and how to encourage more to join; and sustainable trade issues suggested by the hosts – New Zealand (trade and gender, trade and indigenous peoples, how to make these agreements relevant to SMEs, fossil fuel and fisheries subsidies etc).

On new entrants, this was the first substantive discussion between members and it was clear that there was no consensus on how to proceed. No “road blocking” issues were raised but the best that could be achieved was an agreement to discuss the matter again in July.

Interestingly, in recent hours, China has been ramping up its call for accession to the trade deal. Recently China’s vice-commerce minister, Wang Shouwen said;

“China is willing to join the CPTPP… and has the capability to fulfil relevant obligations… We hope that all 11 member countries can support our joining.”

Talking to foreign officials attending the Auckland meeting it was clear that they did not feel any sense of urgency over making any decisions on the new accessions. This suggests that we may be some time away from knowing how members decide how to proceed.

NZ-UK Free Trade Agreement

The “finalization” of the UK CPTPP Accession followed passage in the UK of the legislation ratifying and making entry into force of the Australia and New Zealand FTAs possible. It was therefore disconcerting to learn that a last-minute problem had emerged in the UK. Put simply, the Welsh Parliament (Senedd Cymru) was required to approve some of the Secondary Legislation associated with these Agreements, and they had not done so. While some say this is a symptom of the UK being new to negotiating FTAs, everyone is reassuring and saying that this was an unexpected but non-serious issue. We take everyone at their word and hope that this matter can be resolved quickly and that entry into force the FTA can happen in May.

The Prime Minister will be in the UK in early May and will be meeting his counterpart. This will be a great opportunity to discuss this matter.

This FTA is excellent and exporters should be planning now for how best to take advantage of the improved access to the UK market that will result from this Agreement.

NZ-EU Free Trade Agreement

The Prime Minister has announced that he will be travelling to the NATO Summit in Lithuania in July. Hopefully, he can do some side travel to assist the continuing good progress in the EU-NZ FTA. All indications are positive on this FTA too.

NZ-Gulf Cooperation Council Free Trade Agreement

New Zealand’s foremost Trade Policy publication the Farmers Weekly has been doing lots of digging around the FTA with the GCC. This confirms advice we have been receiving – that we should not be expecting any progress in that negotiation anytime soon.

Supply Chains and Logistics

Domestic

Low schedule reliability continues to plague New Zealand supply chains, with reliability still hovering below 20 per cent, far below the global average.

The re-introduction of fixed berth windows has started well in the North Island, but there has been some disruption in the South Island.

The focus on supply chain issues is shifting from one mainly caused by shipping capacity issues, to one now dominated by port capacity issues. As shipping reliability returns to pre-covid normality, port capacity (labour and infrastructure) becomes the bigger issue. Our submissions to the Ministry of Transport and Productivity Commission (see below) have raised this as an important talking point when discussing New Zealand’s supply chain resilience.

International

Global supply chain pressures continue to ease according to the Global Supply Chain Pressure Index. The Index has seen another significant decrease currently sits at -1.06 this is from a high of 4.31 in December 2021 to 0.96 at the start of 2023.

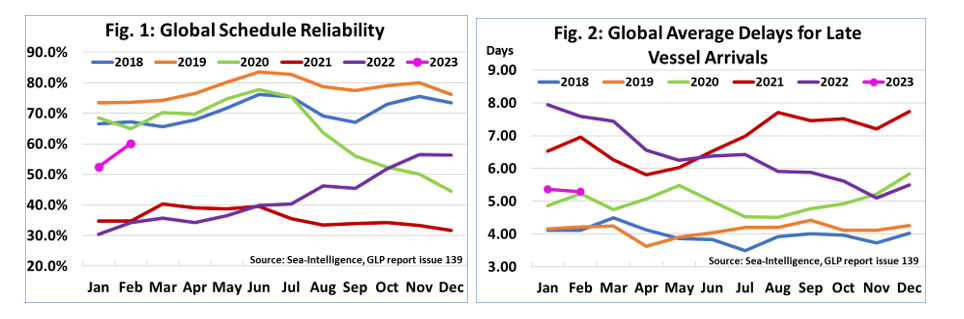

Sea Intelligence now reflects a similar story, as their figures show a sharp increase in global schedule reliability (up to 60.2 per cent, a 7.7 per cent month on month increase). Year on year this figure is a 26 per cent increase from Februuary 2022.

The average global delay for late vessels decreased slightly to 5.29 days.

Credit: Sea Intelligence, 04 April 2023

ExportNZ Letter to Trade Spokespeople

In the lead-up to the election, ExportNZ sent a short letter detailing several key policies areas that are top of mind for New Zealand exporters. The letter is the first part of ExportNZ’s policy engagement before the election, we will be releasing a more detailed pre-election policy document closer to the election as we continue to engage with exporters around the country face to face and through our ExportNZ DHL Export Barometer Survey 2023.

The Letter covered the following issues:

- Support exporters through NZTE overseas,

- Resolving non-tariff barriers,

- Supply chain resilience and reliability,

- Building on our current free trade agreement success,

- Continue to develop free trade agreement relationships with new partners,

- Continue to advocate for the rules-based system,

- Enabling digital/paperless trade,

- Supporting innovative companies,

- Assess & improve the regulatory system in New Zealand for processed foods,

- Confirming the New Zealand Screen Production Grant,

- Staffing and labour shortages,

- Support the Māori economy,

- Support exporters transitioning to a carbon-zero future,

- Support Industry Transformation Plans.

ProdCom: Improving Economic Resilience to Supply Chain Shocks [COMPLETED]

The Government has asked the Productivity Commission to undertake an inquiry into the resilience of the New Zealand economy to supply chain disruptions.

ExportNZ submitted on inquiry and recommended the following initiatives to help enhance the resilience of supply chain resilience:

- Further investment in upgrading and increasing coastal shipping and KiwiRail capacity and further investment in securing main freight lines through the roading network.

- Immigration policy that supports the attraction of migrant workers in the transport and logistics industry.

- Movement and streamlining of infrastructure projects that are of National significance in building capacity and resilience to New Zealand’s supply chain.

- Support for the development of an e-certification process will replace and modernise New Zealand’s electronic certification systems for exporting.

- A focus for officials from the regulatory side, as well as those who are negotiating free trade agreements to keep working to simplify and remove non-tariff barriers that slow down freight.

- New Zealand should continue to make joint commitments on supply chain resilience with our trading partners.

You can access the Productivity Commission Issues Paper HERE, and our ExportNZ submission HERE. We will notify members when the next phase of the inquiry begins.